There's another big risk brewing in China

By Julia Horowitz • Wednesday, September 1 Good morning. In today's newsletter: China's markets have been slammed this year by political intervention in the economy. But there's another big risk. Plus, OPEC and allies meet as oil trades near multi-year highs, and Rep. Alexandria Ocasio-Cortez wants Jerome Powell out.

US stock futures are up after the Dow, S&P 500 and Nasdaq Composite finished August's last trading session in the red. Markets in Europe gained in early trading, following most major indexes in Asia.

▸ Forwarded this newsletter? Want global markets news and analysis from CNN Business reporters every morning? You can sign up here. What's happening now in markets: ▲ Dow futures 35,451 (+0.31%) ▲ S&P futures 4,536 (+0.35%) ▲ Nasdaq futures 15,623 (+0.26%) ▲ US 10-year yield 1.304% ▼ Gold $1,815.60 (-0.14%) ▲ US oil $68.65 (+0.22%) ▲ Bitcoin $47,823.03 (+1.73%) MARKET DATA AS OF 8:05 AM EDT  MARKET FLASH There's another big risk brewing in China There are a number of reasons for global investors to be keeping close watch on China, from signs its economy is slowing to Beijing's disruptive crackdown on private business. But the list doesn't end there.

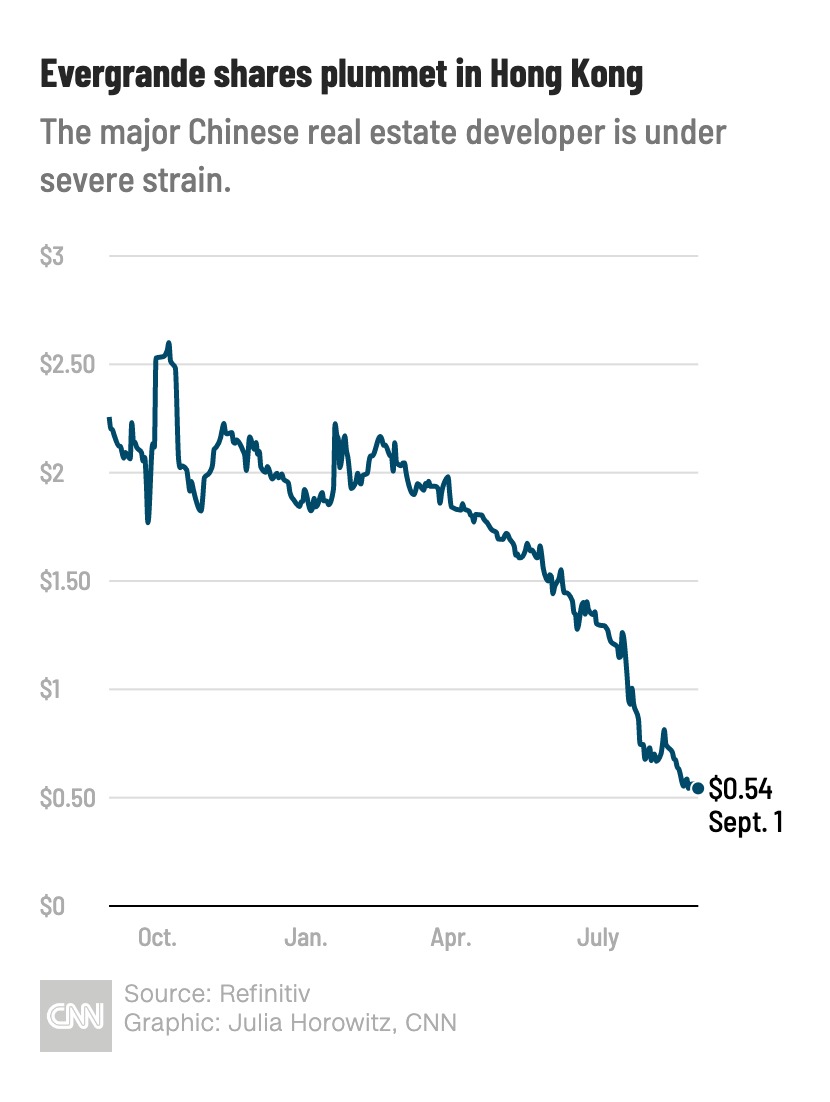

What's happening: Evergrande, one of China's largest property developers, is in dire straits. It warned this week that it could default on its substantial debts, listing $300 billion in total liabilities, if it can't raise money quickly. Should that happen, the effects would be felt across the country's banking system. The group has also suspended work on some projects as it tries to conserve cash, a move that's poised to hit China's property sector.

Investors are clearly worried. Evergrande's shares in Hong Kong are off 72% this year. That's significantly worse than the 29% plunge suffered by Alibaba, which has been at the center of the Chinese government's efforts to rein in big tech firms. Hong Kong's Hang Seng is off 4% year-to-date.  The company's bonds are also under pressure, as is its electric vehicle business, which Bloomberg recently identified as the worst performing stock in the world.

Step back: Debt in China's property sector has been a lingering risk to the country's financial system for some time. And Evergrande is one of China's most heavily indebted developers. It has $37 billion in borrowing due within one year.

Should Evergrande actually default, it would be another destabilizing jolt at an already tenuous moment for markets and the economy.

Though not guaranteed, Beijing would likely intervene to soften the blow, Julian Evans-Pritchard, senior China economist at Capital Economics, said in a note to clients in July.

"China's leadership is presumably reluctant to offer a bailout to Evergrande, given the desire to punish reckless behavior by private entrepreneurs and discourage speculative property investment," he wrote. "But given the firm's sheer size and systemic role, officials would step in to try to ensure an orderly restructuring in the event of a default."

That said: A default would likely lead to tighter financing conditions for the entire real estate sector, hurting their businesses.

"Even if other developers avoid a similar fate, construction activity is likely to suffer as they are forced to pare back new projects," Evans-Pritchard said.

Why it matters: China's economy is stuttering due to its aggressive approach to constraining the Delta variant and supply chain woes. The Caixin index tracking the country's manufacturing sector, released Wednesday, fell to 49.2 in August, indicating the first contraction since April 2020. Meanwhile, Chinese markets have plunged this year as authorities target tech, education and other private enterprises, wiping $3 trillion off the market value of the country's biggest companies.

A major default is the last thing China needs right now.

VOICES Google pushes its return to the office back to 2022 "For some locations, conditions are starting to improve, yet in many parts of the world the pandemic continues to create uncertainty."

CEO SUNDAR PICHAI

Read more from CNN Business.  OIL MONITOR OPEC and partners meet as oil trades near multi-year highs  Brent crude futures, the global benchmark for oil prices, are trading near their highest level in more than two years.

That gives the Organization of the Petroleum Exporting Countries and its allies some cover as representatives meet by videoconference on Wednesday.

The latest: OPEC+ is expected to affirm its plan — announced in July — to gradually boost oil production.

"It looks very much as if the timetable for monthly production hikes of 400,000 barrels per day that was agreed in mid-July will be confirmed," Commerzbank analysts said in a note to clients.

It helps that the group's market experts are reportedly predicting a supply deficit of 900,000 barrels per day for the rest of the year thanks to resurgent demand as the economy recovers.

A caveat: The committee foresees an excess of 1.6 million barrels per day next year if OPEC+ continues raising output as planned. That could weigh on prices in the medium-term. But for now, it's a problem for another day.

"The main focus today will be on the production volume in the coming month," Commerzbank said.  UP NEXT Campbell Soup reports earnings before US markets open. Chewy and Smith & Wesson follow after the close. Also today → ▸ The latest ISM Manufacturing Index follows at 10 a.m. ET.

Coming tomorrow: Earnings from Hormel Foods and Broadcom. WHAT WE'RE READING AND WATCHING ▸ India just posted record 20% GDP growth (CNN Business) ▸ Hard seltzer is king. Big beer owns it (CNN Business)  FINAL WORD AOC wants Jerome Powell out of a job Wall Street has been rewarding Federal Reserve Chair Jerome Powell's careful speech at the Jackson Hole symposium last week, when he indicated that the Fed will soon begin winding down its emergency economic stimulus program.

See here: The CNN Business Fear & Greed Index briefly hit "greed" territory late Monday before sliding back into neutral mode Tuesday.

But that doesn't mean everyone is a fan. Progressive Democrats, including New York Rep. Alexandria Ocasio-Cortez, are calling on President Joe Biden to give the Fed a sweeping makeover by replacing Powell as chairman, my CNN Business colleague Matt Egan reports.

"We urge President Biden to reimagine a Federal Reserve focused on eliminating climate risk and advancing racial and economic justice," the lawmakers said in a statement Tuesday.

The backdrop: Powell, a Republican and former investment banker, was nominated in 2017 to lead the powerful Federal Reserve by former President Donald Trump, who later soured on his selection. Powell's term as chair expires in February, and the White House has not said whether he will be reappointed.

Under Powell, the Fed wasted little time responding forcefully to the economic fallout from the pandemic in March 2020. Economists have credited the Fed's historic actions with helping to prevent a full-blown depression and financial crisis in the United States. At a delicate time for the economic recovery, Biden may opt to prioritize continuity.

But the campaign from AOC and colleagues Rashida Tlaib of Michigan, Ayanna Pressley of Massachusetts, Mondaire Jones of New York and Chuy Garcia of Illinois could broaden the conversation about the Fed's role in the economy — and in society.

All CNN Newsletters | Manage Profile

® © 2021 Cable News Network, Inc. A WarnerMedia Company. All Rights Reserved.

One CNN Center Atlanta, GA 30303

|